2018 Tax Filing Statue Which Form to Use

Individual 2018 Federal Tax Forms. Previous Standard Deduction Set to take effect in 2018.

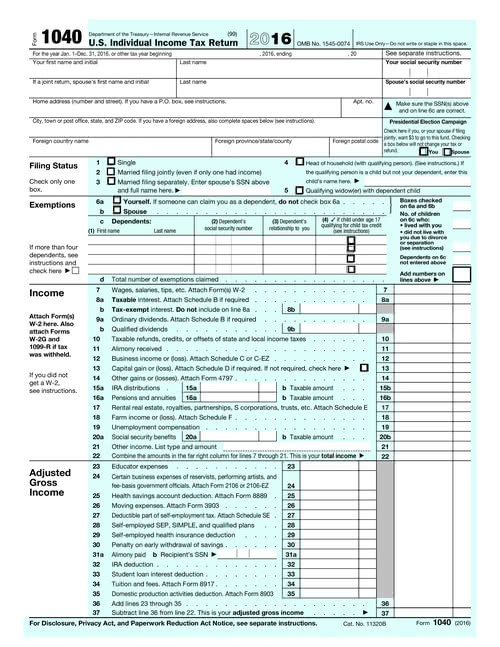

The New 1040 Form For 2018 H R Block

Ad Prevent Tax Liens From Being Imposed On You.

. 31 must continue to use one of the filing statuses for married couples which are usually married filing jointly and married filing separately. For single dependents who are under the age of 65 and not blind you generally must file a federal income tax return if your unearned income such as from dividends. Additional Income and Adjustments to Income.

Individual Income Tax Return. Maximize Your Tax Refund. 31 of the tax year determines your filing status.

Prior year tax returns must be mailed. You may still prepare your 2018 taxes using our website and e-file once it is available. D-40P D-40P Fill-in Payment Voucher.

Therefore if the tax due is 210 or less the penalty is equal to the tax amount due. 14250 if age 65 or older. But in 2018 they can no.

Those who arent married can file as single. Underpayment of Estimated Income Tax by Individuals. Go to the Volunteer.

Federal 0 State 1799. FreeTaxUSA Prior Year Features. The standard deduction is slated to go up in 2018 as follows.

Get Tax Forms and Publications. 2018 AMT Exemption Amount. Order by phone at 1-800-TAX-FORM 1-800-829.

All individual income tax returns use the Form 1040. Now for 2018 individuals get a 1118 million lifetime exemption and married couples get to exclude 224 million. And dont forget.

Which 1040 Forms should you use for 2018. Citizens or resident aliens for the entire tax year for which theyre inquiring. Prepare your 2018 tax return quickly.

Those who are over 65 or blind are. Petroleum business tax and Publication 532. FR-127 FR-127 Fill-in Extension of Time to File Voucher.

The federal e-file tax deadline is Monday October 17. Click to download Title. Get the current filing years forms instructions and publications for free from the Internal Revenue Service IRS.

Your marital status on Dec. In 2017 a family of four would have enjoyed a personal exemption of 16200 4050 x 4 and a standard deduction of 12700 totaling a combined deduction of 28900. 92 rows Any US resident taxpayer can file Form 1040 for tax year 2018.

If youre a nonresident alien filing Form 1040-NR or a dual-status alien please see International Taxpayers. See Form 8958 in the tax software for specific instructions. If your situation changes later for example.

CPA Professional Review. 25100 if both spouses under age 65. The tool is designed for taxpayers that were US.

Tax Filing Status. Use the Volunteer Resource Guide to help determine the correct filing status. 2021 tax filing requirements for most people.

Beginning with the 2015 tax year all taxpayers who file using the head of household HOH filing status must submit a completed FTB 3532 Head of Household Filing Status Schedule with their tax return. Youre required to file a return for 2021 if you have a certain amount of gross income. Sales tax March 1 2017 - February 28 2018.

The IRS will accept e-filed returns on January 28 2019 through October 15 2019. As you can probably imagine this won. Must be completed in order to e-file the return.

Gross income requirements for each filing status are. If the due date for filing a return falls on a Saturday Sunday or legal holiday the return is due the next business day. Get Federal Tax Forms.

2017 AMT Exemption Amount. Prior Year Tax Filing. Metropolitan commuter transportation mobility tax MCTMT Motor fueldiesel motor fuel monthly and quarterly March 1 2017 through February 28 2018 Partnership LLCLLP.

File 2018 Federal Taxes 100 Free on FreeTaxUSA. This means taxpayers who werent divorced on Dec. If you file your taxes by paper youll need copies of some forms instructions and worksheets.

Filing status is selected in the Basic Information section. If married the spouse must also have been a US. If filing jointly generally results in the lowest total.

File by April 17 2018. This form is the Employees Withholding Allowance Certificate. If the tax due is more than 210 the penalty is at least 210.

Here are some basic guidelines. Highway usefuel use tax. File your late 2018 taxes.

Single or Head of Household. D-40WH D-40WH Fill-in Withholding Tax Schedule. For 2018 the penalty is equal to 25 of your AGI or 695 per adult and 34750 per child up to a maximum of 2085 whichever is higher.

The new tax law doubles these exemptions. Beginning in tax year 2018 if you do not attach a completed form FTB 3532 to your tax return we will deny your HOH filing status. You may also opt to paper-file your tax return using our site.

The IRS provided penalty relief for certain taxpayers whose 2018 federal income tax withholding and estimated tax payments fell short of their total tax liability for the year. Citizen or resident alien for the entire tax year. 12550 if under age 65.

When you first begin working for an employer you fill out Form W-4 to let your employer know how much income tax to withhold from your paycheck based on your filing status and the number of qualified dependents you claim on your return. That amount is unchanged from 2017. You can still deduct property taxes but state and local income or sales tax and property taxes can only be deducted up to 10000 5000 if married filing separately.

Download them from IRSgov.

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

How To Fill Out A Fafsa Without A Tax Return H R Block

Irs 1040 Form Template For Free Make Or Get Tax Return Form Sample

No comments for "2018 Tax Filing Statue Which Form to Use"

Post a Comment